Arbitrage Guide

Overview

The Yield Basis system maintains 2x leverage through two key mechanisms:

- AMM (Automated Market Maker): Uses mathematical bonding curves to maintain constant leverage

- Virtual Pool: Enables arbitrage without requiring users to handle LP tokens directly

Arbitrage opportunities arise when:

- AMM prices deviate from Curve pool prices

- Leverage ratios drift from the target 2x

How the VirtualPool routes trades

The VirtualPool enables arbitrage between STABLECOIN (i=0) and ASSET (i=1) using the Curve pool and the market's LEVAMM, facilitated by a flash loan of the stablecoin from Factory.flash().

- Flash loan covers only the opposite leg: you supply the input token (BTC or crvUSD); the VirtualPool flash-borrows stablecoin (crvUSD) internally.

- No LP handling: LP mint/burn is internal—users never receive LP tokens.

- Safety & leverage: The LEVAMM enforces a constant-leverage curve (L≈2× in YieldBasis) with a safety band; VirtualPool just routes trades through it.

- Protection: Always quote with

get_dy()and setmin_outto avoid unprofitable fills.

Stable → Asset Swaps (i=0, j=1):

- User sends crvUSD to VirtualPool.

- VirtualPool takes a stablecoin flash loan.

- VirtualPool buys LP from the AMM:

AMM.exchange(0, 1, user_stable*(1−ROUNDING_DISCOUNT)+flash, 0). - VirtualPool removes liquidity in the Curve pool:

POOL.remove_liquidity(lp_amount, [0,0]). - VirtualPool repays the flash loan from the stable side.

- Remaining asset is transferred to the user.

Asset → Stable Swaps (i=1, j=0):

- User sends BTC to VirtualPool.

- VirtualPool takes a stablecoin flash loan.

- VirtualPool mints LP in the Curve pool:

POOL.add_liquidity([flash, user_asset], 0). - VirtualPool sells LP to the AMM:

AMM.exchange(1, 0, lp_amount, 0). - VirtualPool repays the flash loan.

- Remaining stablecoin is transferred to the user.

The flash callback enforces that the caller is the configured flash provider and the borrowed token is the stablecoin. A small

ROUNDING_DISCOUNTis applied on stable->asset quotes to avoid over-estimation.

Mathematical Foundation

Leverage Calculation

The AMM maintains leverage through a bonding curve:

# AMM.vy

def get_x0(p_o: uint256, collateral: uint256, debt: uint256, safe_limits: bool) -> uint256:

# x0 represents the virtual balance maintaining 2x leverage

# p_o = oracle price

# collateral = LP token amount (the AMM's collateral)

# debt = stablecoin debt (interest-accrued where applicable)

# safe_limits = enforce safety band when True

- Target Leverage: 2x (50% debt-to-value ratio)

- Price Increase: DTV < 50% -> Arbitrageurs add debt to restore leverage

- Price Decrease: DTV > 50% -> Arbitrageurs reduce debt to restore leverage

How the code creates (and enforces) arbitrage back to ~2×

The LEVAMM prices trades on a constant-leverage curve anchored to the oracle, and it only accepts trades that move the system toward the safe region around 2×. When debt-to-value (DTV) drifts away from ~50%, the AMM's quoted price for LP ↔ crvUSD shifts so that an external route (Curve mint/burn) + AMM.exchange becomes profitable. VirtualPool packages that route with a flash-loaned stable leg so arbitrageurs never touch LP.

-

State & price basis

get_state()exposes(collateral, debt, x0)wherecollateralis LP amount anddebtis interest-accrued.get_p()derives the AMM price (stable per LP) from the oracle and current state: it usesget_x0(p_o, collateral, debt, False)internally.

-

Safety band (keeps DTV sane)

-

get_x0(p_o, collateral, debt, safe_limits=True)enforces min/max debt vs oracle collateral value (for L=2×, roughly 6.25%–53.125% of value). -

Every trade ends with:

# AMM.exchange(...)

assert self.get_x0(p_o, collateral_after, debt_after, True) >= x0_before, "Bad final state"This rejects trades that would leave safe bounds or move the state toward the "untradable" region. In practice it nudges the system back toward the 2× area.

-

-

Directional inventory changes

- Stable -> LP (

exchange(0,1,…)): reducesdebt, reducescollateral(AMM sells LP for stables to the trader). Used to decrease DTV when the system is over-leveraged. - LP -> Stable (

exchange(1,0,…)): increasesdebt, increasescollateral(AMM buys LP from the trader, paying stables). Used to increase DTV when the system is under-leveraged. These updates are explicit inexchange(...)after computingout_amount.

- Stable -> LP (

Why the price becomes favorable (how the spread appears)

-

Quotes come from the curve, not from the pool:

get_dy(i, j, in_amount)(and its on-chain twin insideexchange(...)) uses the constant-leverage geometry (viax0,x_initial) and appliesfee. The resulting marginal price moves with DTV.- If the AMM is under-leveraged (DTV < 50%), it bids LP aggressively in

get_dy(1->0)(LP->crvUSD). Selling LP to the AMM and redeeming/creating LP via Curve becomes attractive -> arbitrage adds debt (pushes DTV up). - If the AMM is over-leveraged (DTV > 50%), it offers LP cheaply in

get_dy(0->1)(crvUSD->LP). Buying LP from the AMM and burning it to underlying via Curve becomes attractive -> arbitrage reduces debt (pushes DTV down).

- If the AMM is under-leveraged (DTV < 50%), it bids LP aggressively in

-

Oracle-anchored pricing:

get_p()andget_x0()both use the pool's oracle price (PRICE_ORACLE_CONTRACT.price()/price_w()), so quoted trades react to exogenous price moves. After a price jump/drop, the AMM quote shifts immediately, creating the spread vs the Curve mint/burn price that VirtualPool exploits. -

Fees & rounding: Each quote applies

fee(AMM) and, on the VirtualPool's stable->asset path, a smallROUNDING_DISCOUNTto avoid over-estimating user input. These don't create the opportunity, but they set the threshold where arbitrage becomes profitable after gas/flash costs.

How VirtualPool turns the quote into an executable arb

VirtualPool's exchange(i, j, in_amount, min_out) wraps the profitable side without LP custody:

- Stable → Asset Swaps (crvUSD->BTC): flash-borrow stable ->

AMM.exchange(0,1, …)(stable->LP) ->POOL.remove_liquidity(lp, [0,0])-> repay flash from the stable side -> user receives asset. - Asset → Stable Swaps (BTC->crvUSD): flash-borrow stable ->

POOL.add_liquidity([flash, asset], 0)(mint LP) ->AMM.exchange(1,0, lp, 0)(LP->stable) -> repay flash -> user receives crvUSD.

Because the AMM quote improves in the direction that restores 2×, the combined AMM+Curve route yields positive edge whenever DTV has drifted enough to cover fees. The final assert in AMM.exchange guarantees that any executed trade has moved the state toward safety, never away.

Relevant functions to read:

- AMM:

get_state,get_p,get_dy,exchange,get_x0,set_rate,fee,MIN_SAFE_DEBT,MAX_SAFE_DEBT- see AMM documentation - VirtualPool:

get_dy,exchange,_calculate,onFlashLoan- see VirtualPool documentation

Arbitrage Profit Calculation

Use VirtualPool.get_dy() to calculate expected output tokens:

📋 VirtualPool.get_dy() Source Code

# i=0: crvUSD -> BTC, i=1: BTC -> crvUSD

out = VirtualPool.get_dy(i, j, in_amount)

@internal

@view

def _calculate(i: uint256, in_amount: uint256, only_flash: bool) -> (uint256, uint256):

stables_in_pool: uint256 = staticcall POOL.balances(0)

out_amount: uint256 = 0

if i == 0:

state: AMMState = staticcall AMM.get_state()

pool_supply: uint256 = staticcall POOL.totalSupply()

fee: uint256 = staticcall AMM.fee()

r0fee: uint256 = stables_in_pool * (10**18 - fee) // pool_supply

# Solving quadratic eqn instead of calling the AMM b/c we have a special case

b: uint256 = state.x0 - state.debt + in_amount - r0fee * state.collateral // 10**18

D: uint256 = b**2 + 4 * state.collateral * r0fee // 10**18 * in_amount

flash_amount: uint256 = (isqrt(D) - b) // 2 # We received this withdrawing from the pool

if not only_flash:

crypto_in_pool: uint256 = staticcall POOL.balances(1)

out_amount = flash_amount * crypto_in_pool // stables_in_pool

# Withdrawal was ideally balanced

return out_amount, flash_amount

else:

crypto_in_pool: uint256 = staticcall POOL.balances(1)

flash_amount: uint256 = in_amount * stables_in_pool // crypto_in_pool

if not only_flash:

pool_supply: uint256 = staticcall POOL.totalSupply()

lp_amount: uint256 = pool_supply * in_amount // crypto_in_pool

out_amount = staticcall AMM.get_dy(1, 0, lp_amount) - flash_amount

return out_amount, flash_amount

# Check expected crvUSD output for BTC input

expected_crvusd = VirtualPool.get_dy(1, 0, 0.1 * 10**8) # BTC -> crvUSD

# Check expected BTC output for crvUSD input

expected_btc = VirtualPool.get_dy(0, 1, 10_000 * 10**18) # crvUSD -> BTC

Important: The VirtualPool handles the entire arbitrage process internally:

- Takes your input (BTC or crvUSD)

- Executes LP ↔ crvUSD trades using flash loans

- Returns the entire output amount in the output token (crvUSD or BTC)

Note: get_dy() already reflects the full internal route (AMM + Curve + flash repay). No LP math needed.

See this Google Colab notebook for a working example of calculating expected outputs.

Arbitrage Scenarios

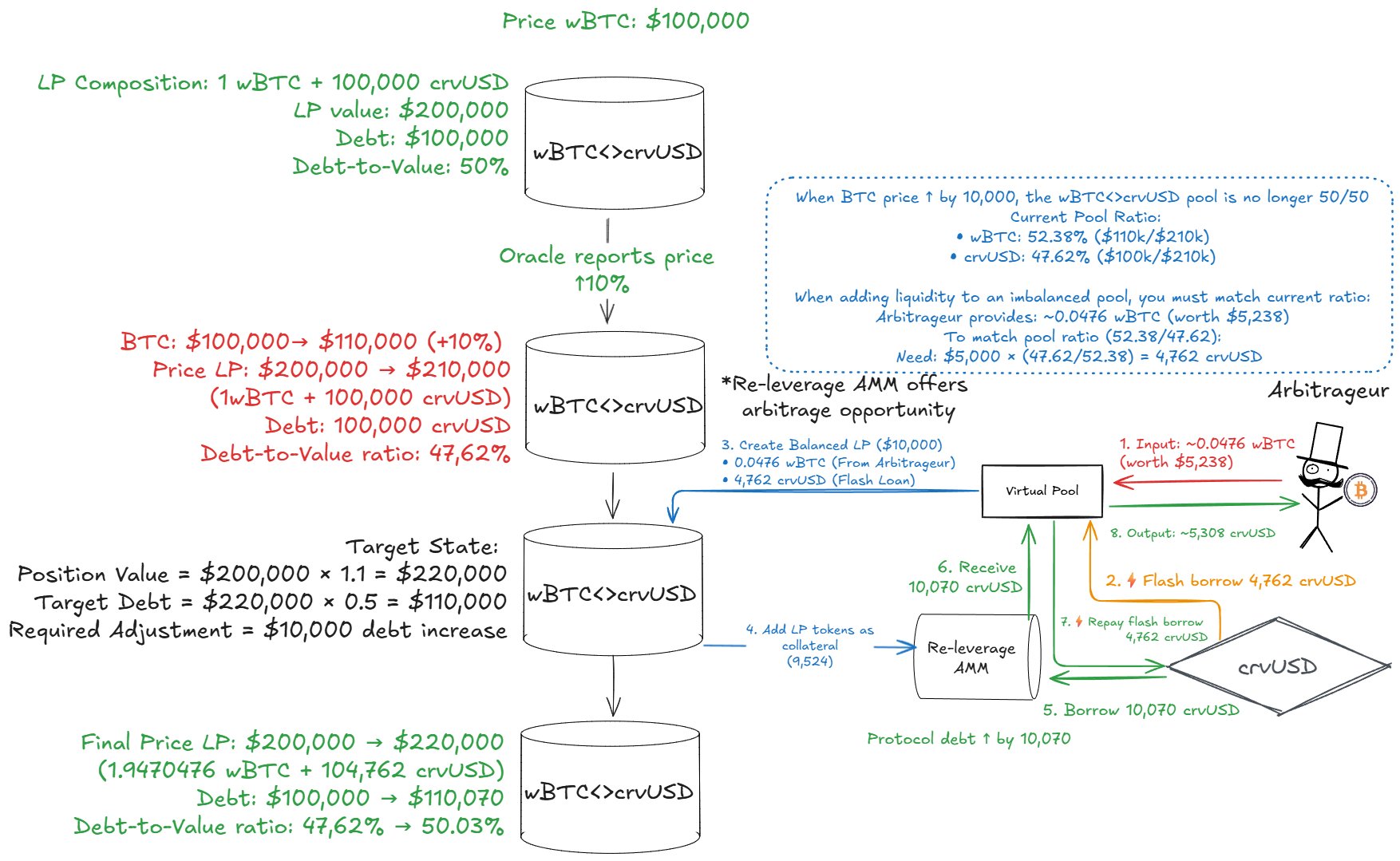

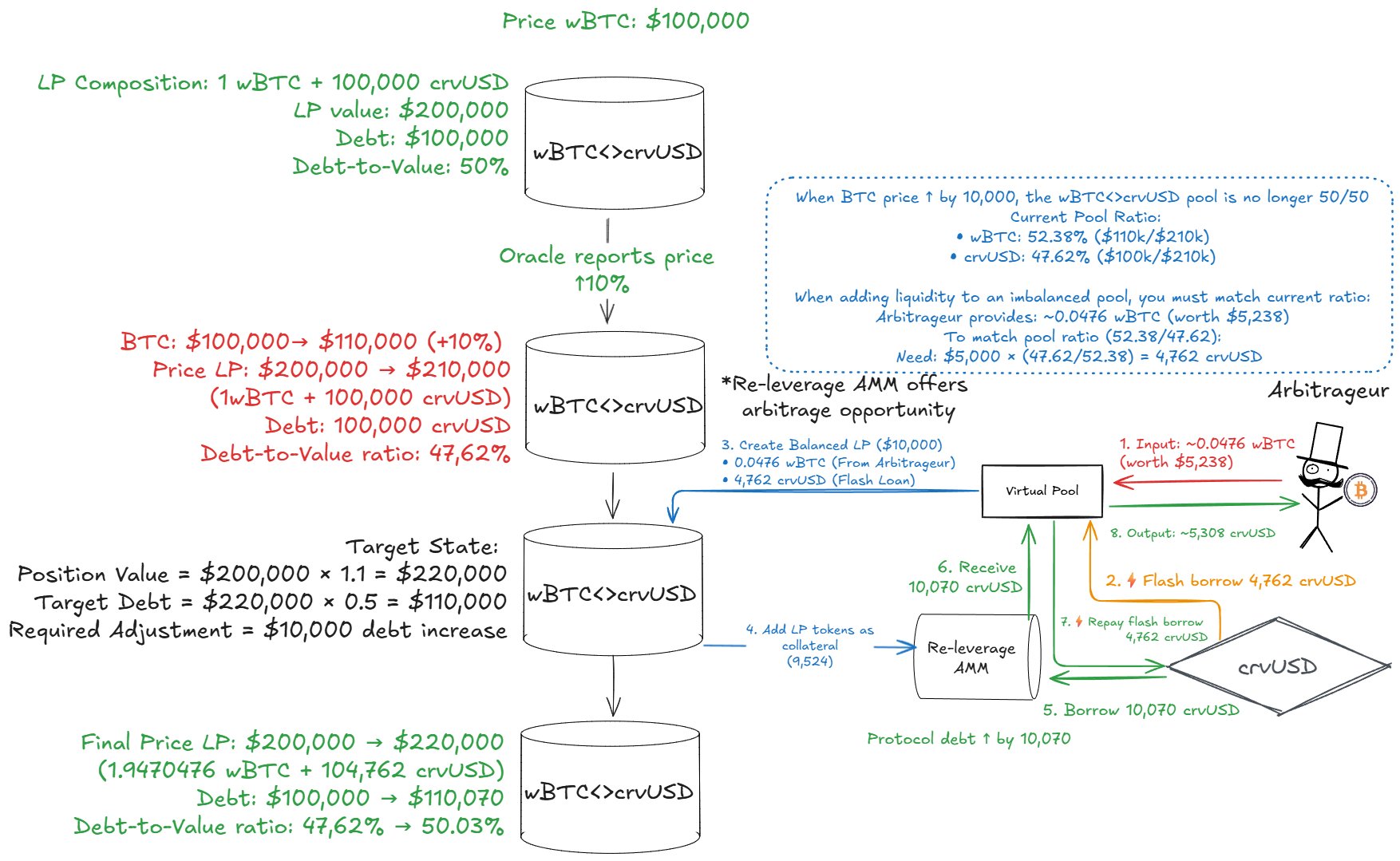

Scenario 1: BTC Price Increases

Example Arbitrage Flow During Price Increases

BTC price increases from $100,000 to $110,000 (+10%)

Initial State:

- LP Composition: 1 BTC + 100,000 crvUSD

- LP Value: $200,000

- Debt: $100,000

- Debt-to-Value: 50%

After Price Increase:

- LP Value: $210,000 (1 BTC × $110,000 + 100,000 crvUSD)

- Debt: $100,000 (unchanged)

- Debt-to-Value: 47.62% (below target 50%)

Why Arbitrage Opportunity Exists: The AMM's bonding curve pricing creates an incentive when DTV ≠ 50%:

- Current DTV: 47.62% (under-leveraged)

- Target DTV: 50% (2x leverage)

- AMM Trading: AMM trades LP tokens ↔ crvUSD

- Arbitrage Opportunity: When under-leveraged, AMM offers better prices for selling LP tokens (getting crvUSD)

- Economic Incentive: Arbitrageurs can profit by selling LP tokens to the AMM, which reduces the AMM's LP position and increases its crvUSD, restoring 50% DTV

Arbitrage Process:

Note: The Virtual Pool handles all the complex logic internally. Arbitrageurs simply call VirtualPool.exchange().

Internal Steps (handled automatically by Virtual Pool):

- Input: BTC to Virtual Pool via

VirtualPool.exchange(1, 0, asset_in, min_out) - Flash borrow: stablecoin from

Factory.flash() - Mint LP:

POOL.add_liquidity([flash_stable, asset_in], 0)-> mint LP - Sell LP:

AMM.exchange(1, 0, lp_amount, 0)-> LP -> stable - Repay flash: from stable side

- Output: remaining stablecoin (crvUSD) -> arbitrageur

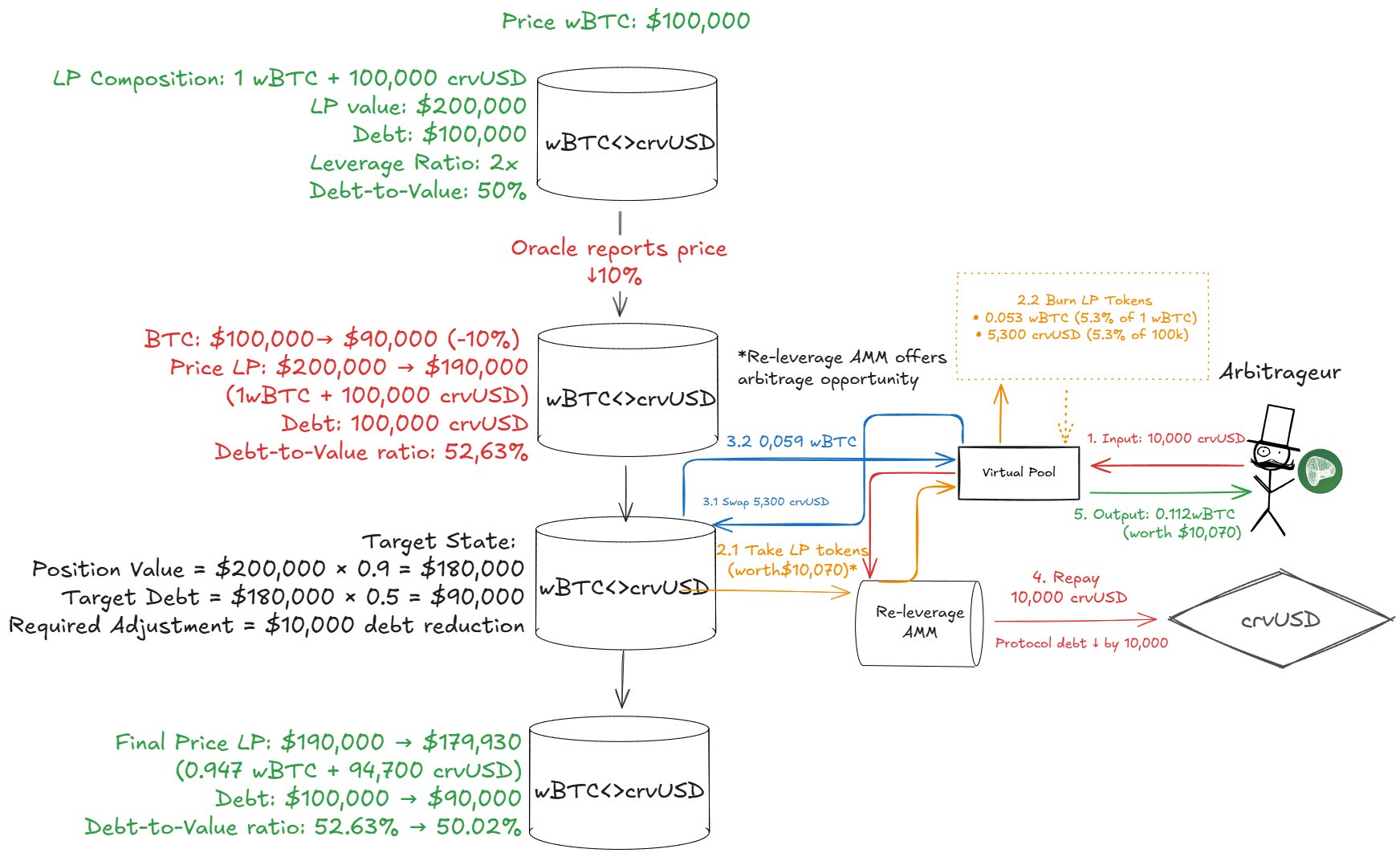

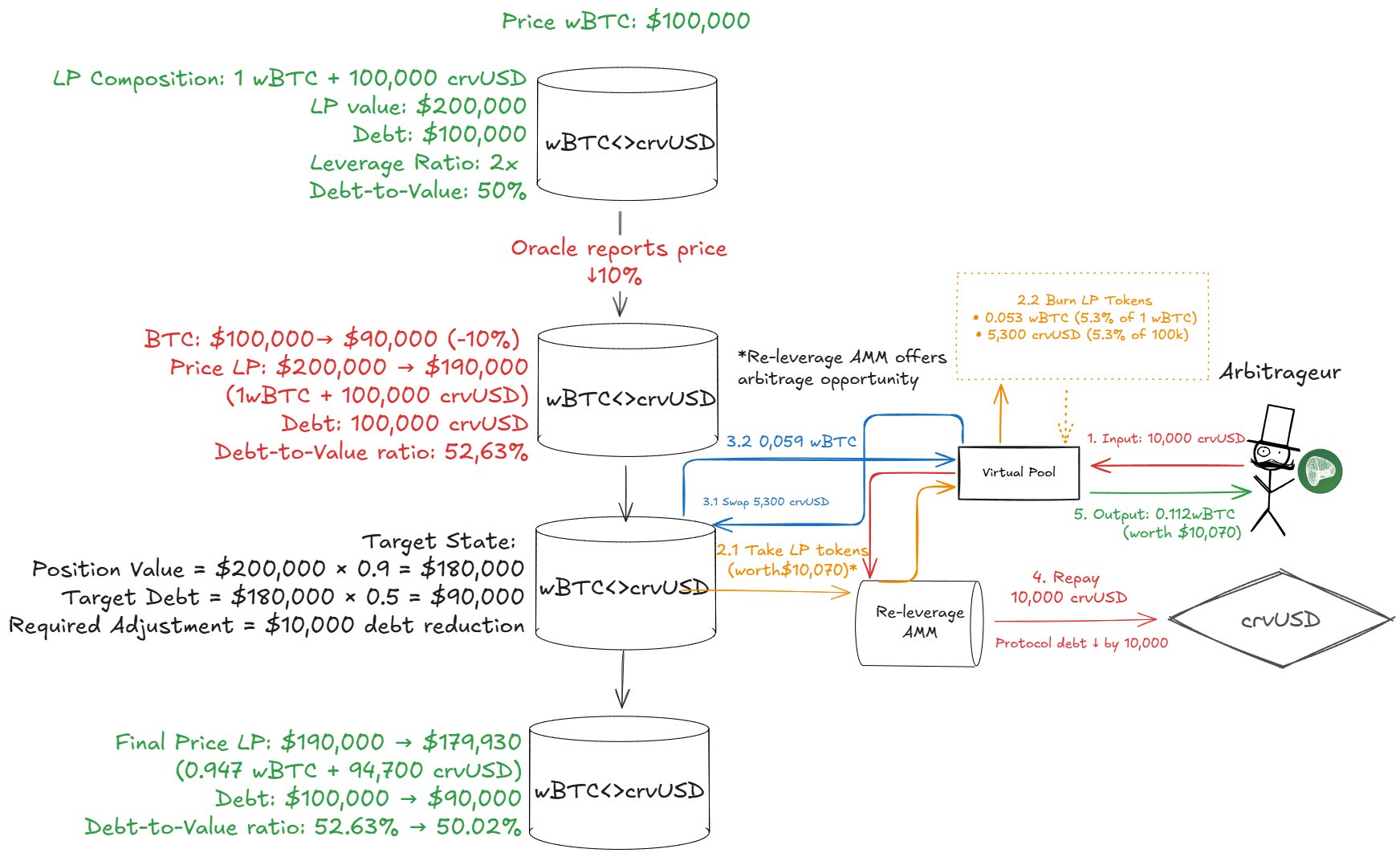

Scenario 2: BTC Price Decreases

Example Arbitrage Flow During Price Decrease

BTC price decreases from $100,000 to $90,000 (-10%)

Initial State:

- LP Composition: 1 BTC + 100,000 crvUSD

- LP Value: $200,000

- Debt: $100,000

- Debt-to-Value: 50%

After Price Decrease:

- LP Value: $190,000 (1 BTC × $90,000 + 100,000 crvUSD)

- Debt: $100,000 (unchanged)

- Debt-to-Value: 52.63% (above target 50%)

Why Arbitrage Opportunity Exists: The AMM's bonding curve pricing creates an incentive when DTV ≠ 50%:

- Current DTV: 52.63% (over-leveraged)

- Target DTV: 50% (2x leverage)

- AMM Trading: AMM trades LP tokens ↔ crvUSD

- Arbitrage Opportunity: When over-leveraged, AMM offers better prices for buying LP tokens (spending crvUSD)

- Economic Incentive: Arbitrageurs can profit by buying LP tokens from the AMM, which increases the AMM's LP position and reduces its crvUSD, restoring 50% DTV

Arbitrage Process:

Note: The Virtual Pool handles all the complex logic internally. Arbitrageurs simply call VirtualPool.exchange().

Internal Steps (handled automatically by Virtual Pool):

- Input: crvUSD to Virtual Pool via

VirtualPool.exchange(0, 1, stable_in, min_out) - Flash borrow: stablecoin from

Factory.flash() - Buy LP:

AMM.exchange(0, 1, stable_in*(1-ROUNDING_DISCOUNT) + flash, 0)-> stable -> LP - Remove liquidity:

POOL.remove_liquidity(lp_amount, [0, 0])-> LP -> (stable, asset) - Repay flash: from stable side

- Output: remaining asset (BTC) -> arbitrageur

How to Execute Arbitrage

Step 1: Check for Arbitrage Opportunities

Price Comparison:

- Get AMM LP price:

AMM.get_p()- returns stable per LP (see AMM documentation) - Get Curve LP price:

POOL.lp_price()(orPOOL.get_virtual_price()) - returns stable per LP - Compare LP prices to identify opportunities

Leverage Check:

- Get current AMM state:

AMM.get_state()- returns(collateral, debt, x0)(see AMM documentation) - Calculate current DTV ratio:

debt / (collateral * price)(use the oracle price, notget_p()) - Target DTV should be 50% (2x leverage)

Step 2: Calculate Expected Profit

For Price Increase Arbitrage:

# Calculate expected output from Virtual Pool

expected_output = VirtualPool.get_dy(1, 0, btc_amount)

profit = expected_output - btc_amount * market_price

For Price Decrease Arbitrage:

# Calculate expected output from Virtual Pool

expected_output = VirtualPool.get_dy(0, 1, stablecoin_amount)

profit = expected_output - stablecoin_amount / market_price

Step 3: Execute Arbitrage

Price Increase (BTC -> crvUSD):

# Call Virtual Pool exchange

VirtualPool.exchange(1, 0, btc_amount, min_out_amount)

Price Decrease (crvUSD -> BTC):

# Call Virtual Pool exchange

VirtualPool.exchange(0, 1, stablecoin_amount, min_out_amount)

Key Functions for Arbitrage

VirtualPool Functions

get_dy() - Expected Output:

# Returns expected output in either stablecoin or asset

# i=0: stablecoin, i=1: asset

expected_output = VirtualPool.get_dy(i, j, in_amount)

coins() - Token Addresses:

# Get token addresses

stablecoin = VirtualPool.coins(0) # crvUSD address

asset = VirtualPool.coins(1) # BTC address

AMM Functions

get_state() - Current State:

# Returns (collateral, debt, x0)

state = AMM.get_state()

collateral = state[0] # LP token amount

debt = state[1] # Interest-accrued debt

x0 = state[2] # Virtual balance for 2x leverage

Calculate Current DTV Ratio:

def calculate_dtv_ratio():

state = AMM.get_state() # collateral (LP), debt, x0

p_o = PRICE_ORACLE_CONTRACT.price() # oracle price

# Include the same precision scaling you use elsewhere if needed

collateral_value = p_o * state.collateral

dtv = state.debt * 10**18 // collateral_value

return dtv # ~5e17 (50%) at target