FAQ

Balance Fluctuations & Recovery

Why did my balance drop?

There are three distinct reasons your balance appears lower.

- Pool Imbalance (TRD) | Leverage drifted from 2x

- Volatility Decay | Costs of maintaining 2x leverage

- crvUSD Peg | crvUSD trading below $1

These can happen independently or simultaneously. None are permanent if you hold your position.

Pool Imbalance (Temporary Redemption Discount)

What is TRD?

Temporary Redemption Discount (TRD) occurs when leverage drifts from its 2x target during rapid price movements.

YieldBasis maintains 2x leverage by keeping debt at exactly 50% of LP value. When BTC moves quickly:

- BTC goes up: Debt ratio falls below 50%

- BTC goes down: Debt ratio rises above 50%

Until arbitrageurs restore the 50% ratio, there's a temporary discount on redemptions.

How does TRD resolve?

Arbitrageurs fix it automatically. The LEVAMM quotes a profitable price for trades that restore the 50% ratio. Arbitrageurs call the Virtual Pool and pocket the spread while re-leveraging the pool.

You don't need to do anything. The discount shrinks with each arbitrage trade.

Where can I check the current TRD?

Check the Analytics page. TRD is shown on the right side of the table.

Volatility Decay & Recovery

What is Volatility Decay?

Volatility Decay is the cost of maintaining 2x leverage. Every time arbitrageurs help maintain leverage, they take a small profit. This is the "price" of eliminating impermanent loss.

In normal markets, trading fees easily exceed these costs, and your position grows. During high volatility with low volume, leverage costs can temporarily exceed fee income.

Key distinction from TRD:

- TRD = A temporary discount visible when leverage has drifted from 2x. Disappears once arbitrageurs restore balance.

- Volatility Decay = The cost of re-leveraging. Each time arbitrageurs restore the debt ratio, they take a small profit — that's the "decay."

How does Recovery Mode work?

Whenever the share value (PPS) drops below its all-time high (the "High Watermark"), the protocol enters Recovery Mode.

What actually happens:

- The protocol tracks the difference between the share value and the watermark (

v_st_loss = ideal_staked - current_staked_value) - When there's positive profit (

value_change > 0), that profit first covers the loss - Admin fees pause on recovery — The protocol doesn't take its cut on profits used to restore share value

- Once share value reach the watermark (

v_st_lossreaches zero), do admin fees resume

Why don't I see Admin Fees accruing?

Short Answer: The protocol is currently below its High Watermark. Admin fees are paused on profits used to restore share value. Once share value recover, admin fees resume.

How fast is the recovery?

Recovery speed depends entirely on Trading Volume vs. Volatility.

- Stagnation: If the price trends down slowly with low volume, fees accumulate slowly. The protocol stays in Recovery Mode longer, slowly erasing the TRD over days or weeks.

- Sideways: In calm markets, costs are low, and the protocol quickly exits Recovery Mode and resumes distributing Admin Fees.

- High Volume: If the market is volatile but active, massive trading fees generated by the pool are poured back into your position. Recovery can be very fast, even if you don't see "Admin Fees" ticking up.

crvUSD Peg Inheritance

Why did my balance drop without high volatility?

Your position's value is calculated using an oracle that includes crvUSD's current price. When crvUSD trades below $1, the oracle returns a lower value.

Is this a real loss?

No. Your underlying BTC hasn't changed. The accounting is temporarily showing a lower USD value because crvUSD is discounted. When crvUSD repegs to $1, your pricePerShare recovers automatically.

This can happen simultaneously with TRD or volatility decay, making balance drops appear larger than any single cause would suggest.

Impermanent Loss vs. YieldBasis

Is this the same as Impermanent Loss?

No. They're fundamentally different:

- Impermanent Loss (Standard AMMs): A structural loss caused by the divergence of asset prices. Even if fees are high, you often cannot recover the full value relative to holding.

- Volatility Decay (YieldBasis): This is a "maintenance cost" for maintaining 2x leverage. Unlike IL, you do not need the price to return to recover. You only need the system to cover the costs for debt ratio to return to 50%. As long as trading volume exists, the system closes the redemption discount, regardless of where the price goes.

Tokens & Vaults

What's the difference between sybBTC and ybBTC?

ybBTC (Yield Bearing / Unstaked):

- You hold the LP token directly.

- Yield: You earn a share of trading fees.

sybBTC (Staked Vault):

- You deposit your LP tokens into the Staked Vault (Gauge).

- Yield: You forgo organic trading fees to earn $YB emissions (governance tokens).

- Peg: Ideally maintains a 1:1 ratio with BTC.

How do the two tokens interact during a drawdown?

- Shared Lag: If the main pool experiences a lag (drawdown), both tokens will show a temporary value drop.

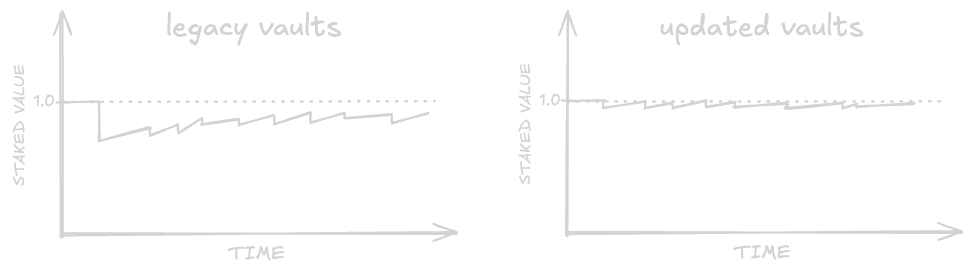

- V2 Stability: In the updated pools, losses are significantly smaller (estimated 10-20x less) during similar volatility compared to legacy pools.

How do I actually receive trading fees?

Trading fees are automatically compounded into the value of your token.

- Generation: The AMM generates fees from traders.

- Collection: The protocol collects these fees via

collect_fees. - Distribution: The value is added to the

totalpool liquidity. This increases the amount of BTC redeemable for every 1 ybBTC. You do not need to manually claim BTC fees.

Migration & Troubleshooting

Why is there a protocol update (V1 to V2)?

The V2 update fixes an issue in the legacy vault where volatility caused excessive fluctuations for staked users.

- Legacy (V1): Staked positions could experience new losses before recovering from previous ones.

- Updated (V2): Changes the value calculation to use

price_scaleconsistent with the AMM.

The code is publicly available for both versions: (1) the legacy code in question (2) the updated version.

Why do I see "Debt too high" when migrating or depositing?

Error: Debt too high

Cause: The pool has reached its current capacity (specifically the crvUSD debt limit) and cannot currently accept new funds.

LPs who have not yet migrated can wait and try again later. Space becomes available when other users withdraw or when the protocol raises the debt limit*.

Important: Migration is not time-limited. You can migrate your position as soon as capacity opens up

*Note: Raising the debt limit requires a Curve DAO vote.

Why do I see "Not enough out" during migration?

Error: Not enough out

Cause: This is a slippage error, the migration contract checks if the amount of new tokens you receive matches your minimum expectation.

Increase your slippage tolerance slightly in the UI (e.g., from 0.1% to 0.5%). Volatility can cause the exchange rate to shift slightly between the time you sign the transaction and when it is processed.

Do I Need to Migrate?

When Curve cryptoswap pools are very imbalanced, it might make sense to wait for a more rebalanced state to migrate to the new version. Pool imbalance can be checked via the Curve UI by searching for the YB pools.

How does migration work?

YieldBasis uses a dedicated LTMigrator contract to handle this in one transaction:

- Withdraw: It withdraws assets from your V1 position.

- Exchange: It moves the liquidity to the new system.

- Deposit: It calls

depositon the new V2 position. Your accumulated fees and emissions are preserved during this process.

Protocol Update: Legacy vs Updated Vaults

Why is there a protocol update?

The YieldBasis team identified an issue in the legacy vault (v1) implementation that causes excessive value fluctuations, particularly affecting staked vault depositors. An updated vault (v2) has been developed that significantly reduces these fluctuations.

The code is publicly available for both versions: (1) the legacy code in question (2) the updated version.