YieldBasis (YB) Tokenomics

YieldBasis ($YB) token is designed as a next-generation ve-Tokenomics model. It enables decentralized protocol governance, rewards distribution, and long-term alignment of token holders with the success of the protocol.

Token Details

- Token Name: YieldBasis

- Token Symbol: YB

- Total Supply: 1,000,000,000 YB (1 Billion)

- Decimals: 18

- Token Standard: ERC-20

- Contract Address:

0x01791F726B4103694969820be083196cC7c045fF

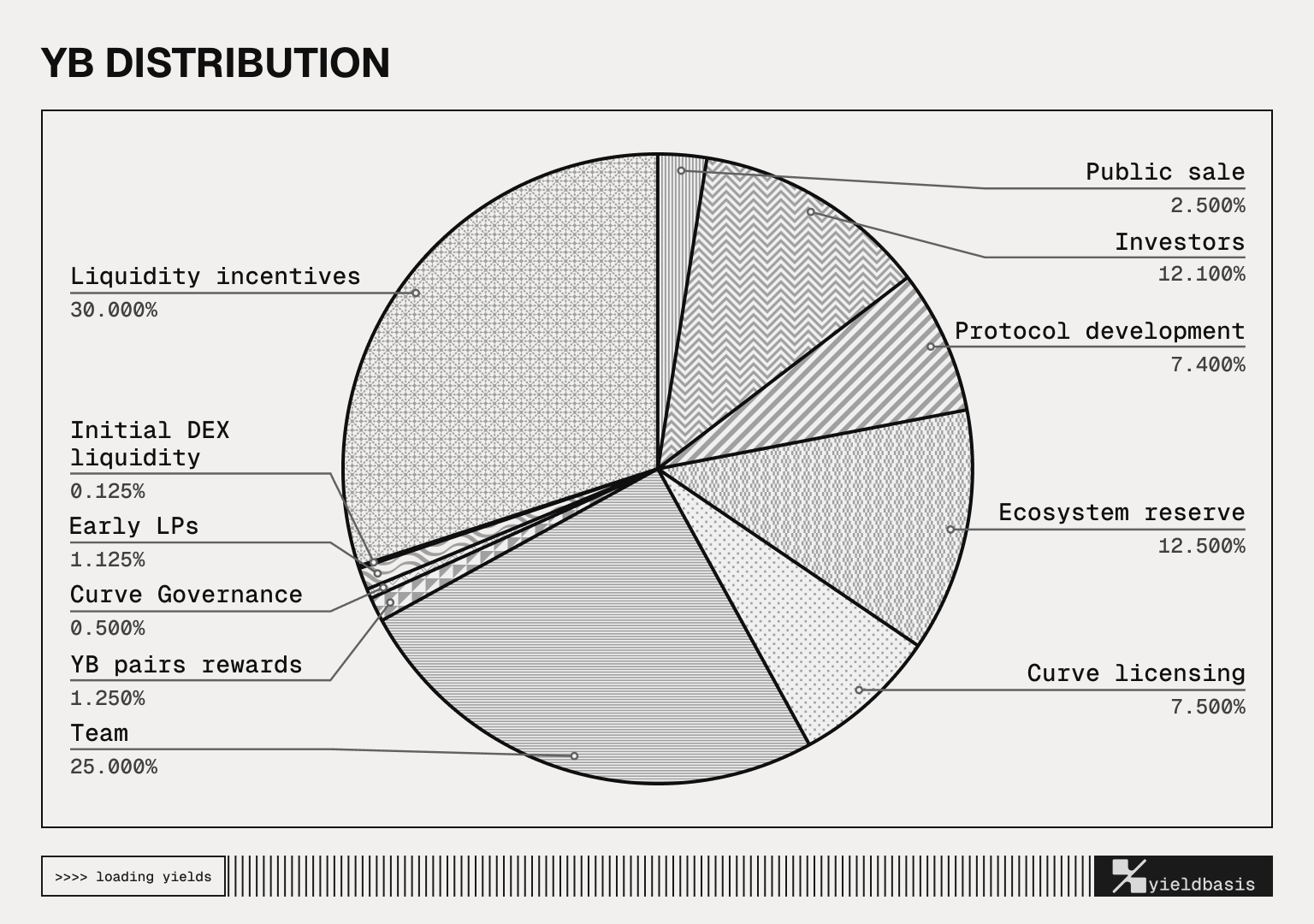

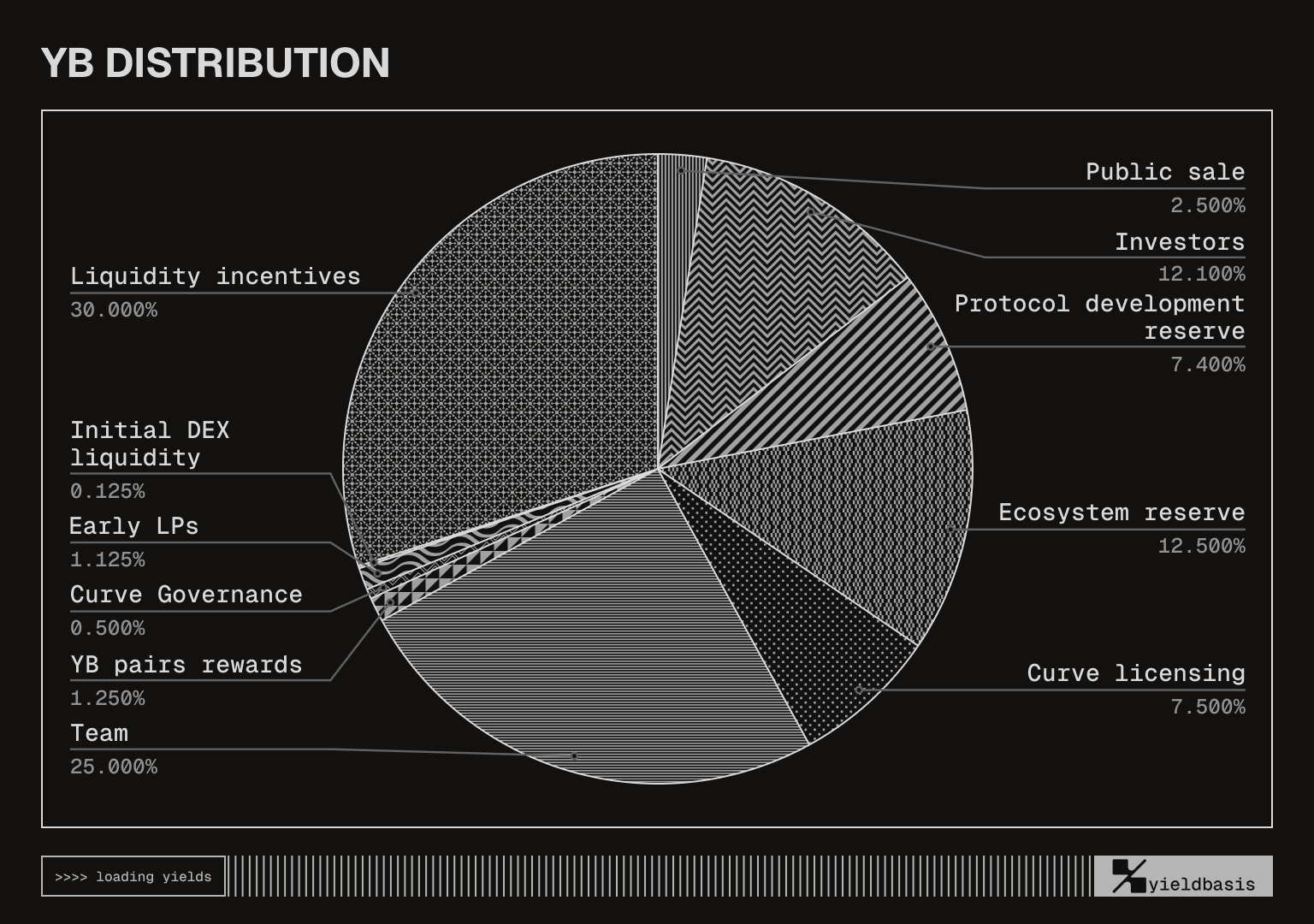

Token Distribution

Distribution

The total $YB supply (fully diluted) amounts to 1 billion (1,000,000,000) tokens.

The distribution of YB tokens amounts to:

| Category | Allocation | Percentage |

|---|---|---|

| Liquidity Incentives | 300,000,000 YB | 30% |

| Team | 250,000,000 YB | 25% |

| Ecosystem Reserve | 125,000,000 YB | 12.5% |

| Investors | 121,000,000 YB | 12.1% |

| Protocol Development Reserve | 74,000,000 YB | 7.4% |

| Curve Licensing | 75,000,000 YB | 7.5% |

| Curve Governance | 5,000,000 YB | 0.5% |

| Early LPs | 11,250,000 YB | 1.125% |

| YB Pair Rewards | 12,500,000 YB | 1.25% |

| Initial YB DEX Liquidity | 1,250,000 YB | 0.125% |

| Public Sale | 25,000,000 YB | 2.5% |

| Total | 1,000,000,000 YB | 100% |

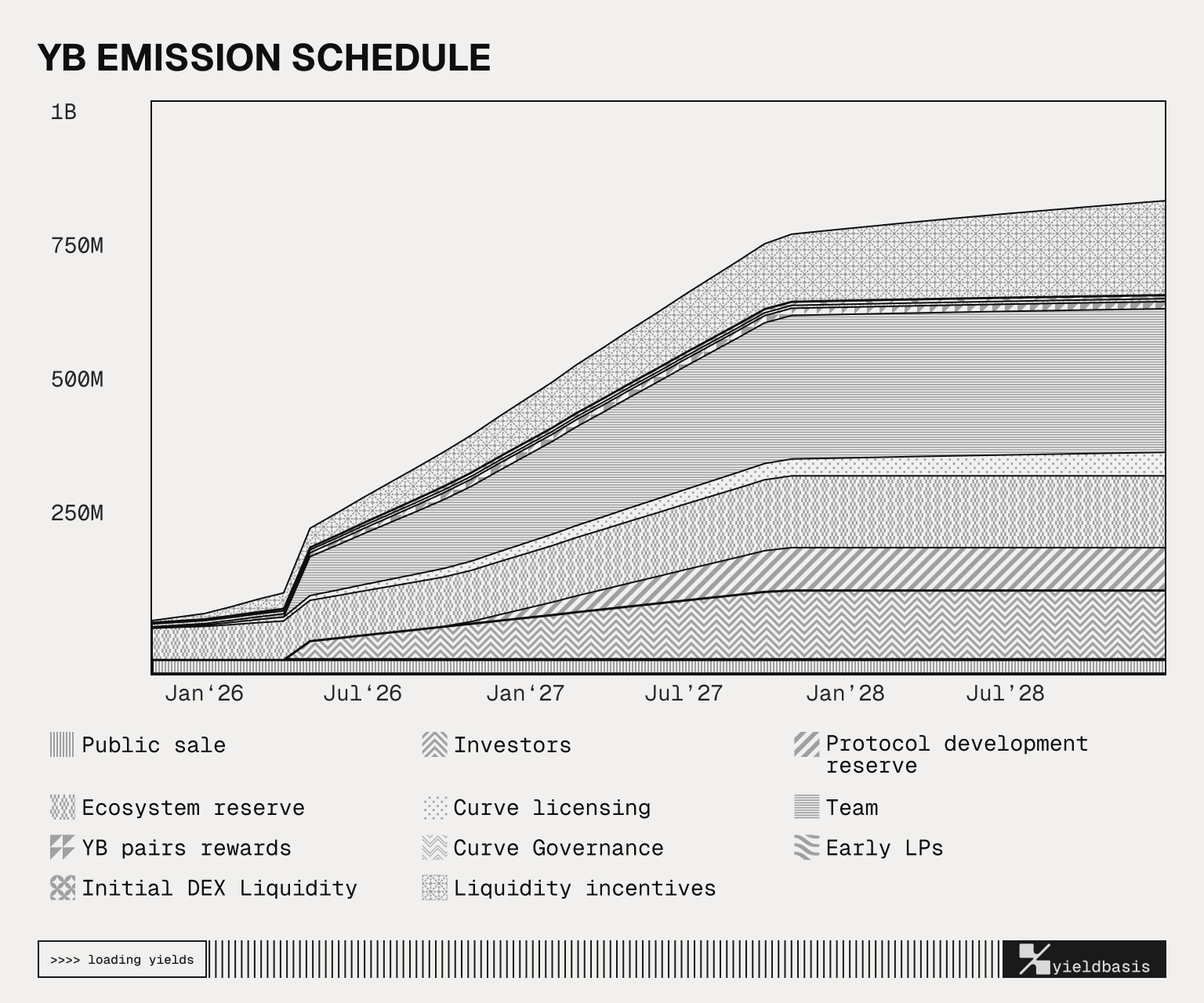

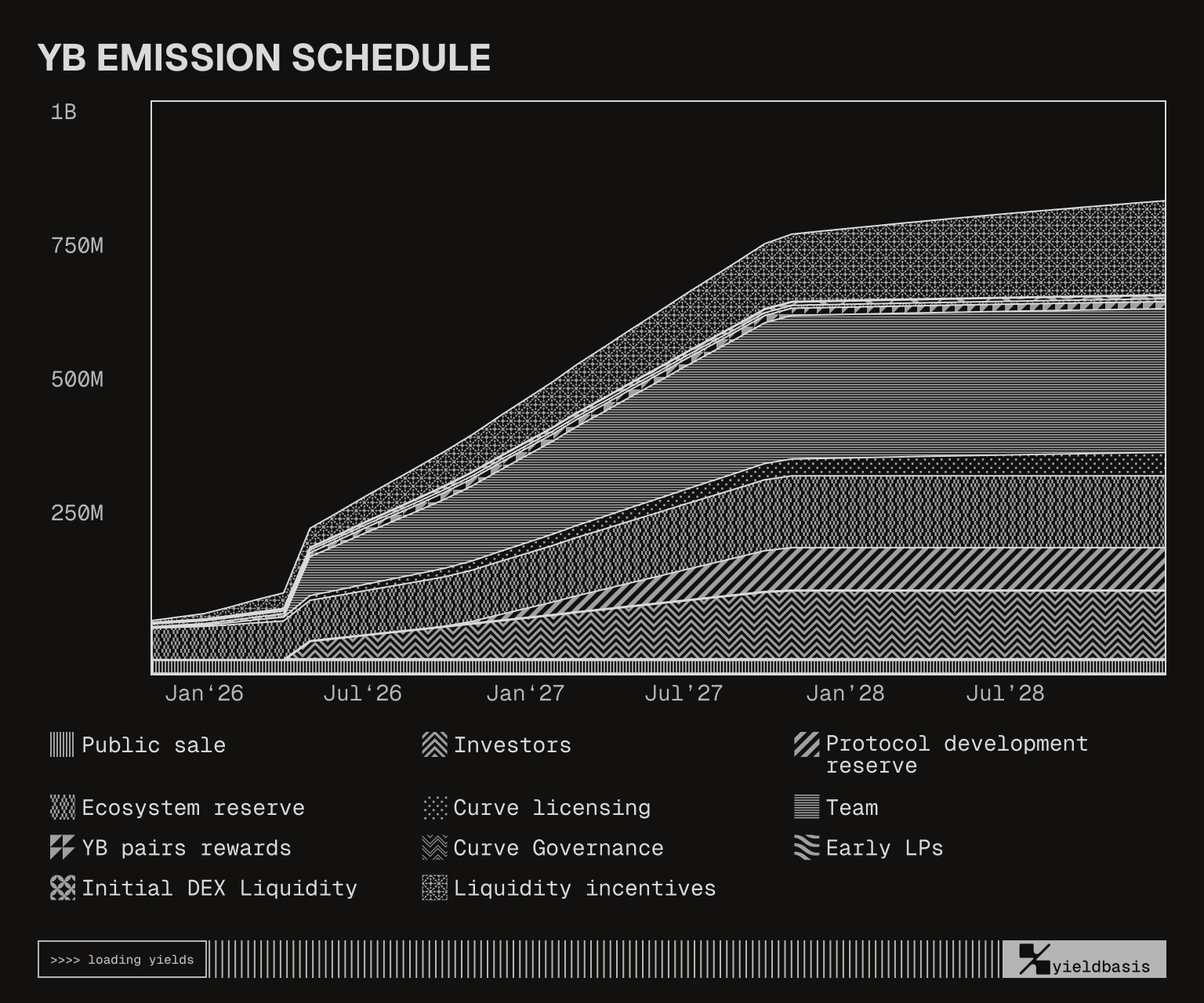

Vesting Schedules

The Yield Basis protocol was deployed on September 15th, and cliff and vesting schedules for the corresponding allocations are effective from this date.

| Category | Allocation | Vesting Schedule |

|---|---|---|

| Liquidity Incentives | 300,000,000 YB | Dynamic emission schedule: the particular number of YB minted over time depends on the Yield Basis LPs stake rate |

| Team | 250,000,000 YB | 2 years vesting with a 6 month cliff starting with protocol deployment The first 6 months tokens are vested under the cliff, which means that they could be claimed only for locking in veYB. In case of Permalock, the veYB NFT cannot be transferred during the first 6 months. |

| Ecosystem Reserve | 125,000,000 YB | 50M at TGE + 2 years linear vesting for remaining 75m YB starting with protocol deployment |

| Investors | 121,000,000 YB | 2 years vesting with a 6 month cliff starting with protocol deployment The first 6 months tokens are vested under the cliff, which means that they could be claimed only for locking in veYB. In case of Permalock, the veYB NFT cannot be transferred during the first 6 months. |

| Protocol Development Reserve | 74,000,000 YB | 1-year cliff starting with protocol deployment followed by 1 year linear vesting |

| Curve Licensing | 75,000,000 YB | The dynamic emission schedule is proportional to YB Liquidity Mining emissions. For example, if a portion of YB emissions are minted, the corresponding portion of the Curve Licensing allocation becomes available to the Curve DAO. |

| Curve Governance | 5,000,000 YB | Fully unlocked at TGE |

| Early LPs | 11,250,000 YB | See breakdown below |

| ↳ Season 1 | 5,625,000 YB | As a result of Season 1, 4046 Early LPs were eligible for YB rewards. The major share of rewards were provided as 12 months linear vest allocation with a minor share of initially unlocked tokens (up to 5,000 YB per LP). Initially unlocked rewards: 736,862 YB Rewards subject to 12 months linear vest: 4,888,138 YB |

| ↳ Season 2 | 5,625,000 YB | TBA |

| YB Pair Rewards | 12,500,000 YB | 1 year linear vesting starting with protocol deployment |

| Initial YB DEX Liquidity | 1,250,000 YB | Fully unlocked at TGE |

| Public Sale | 25,000,000 YB | Fully unlocked at TGE |

Want to understand liquidity mining schedule? Learn more here!