Fees

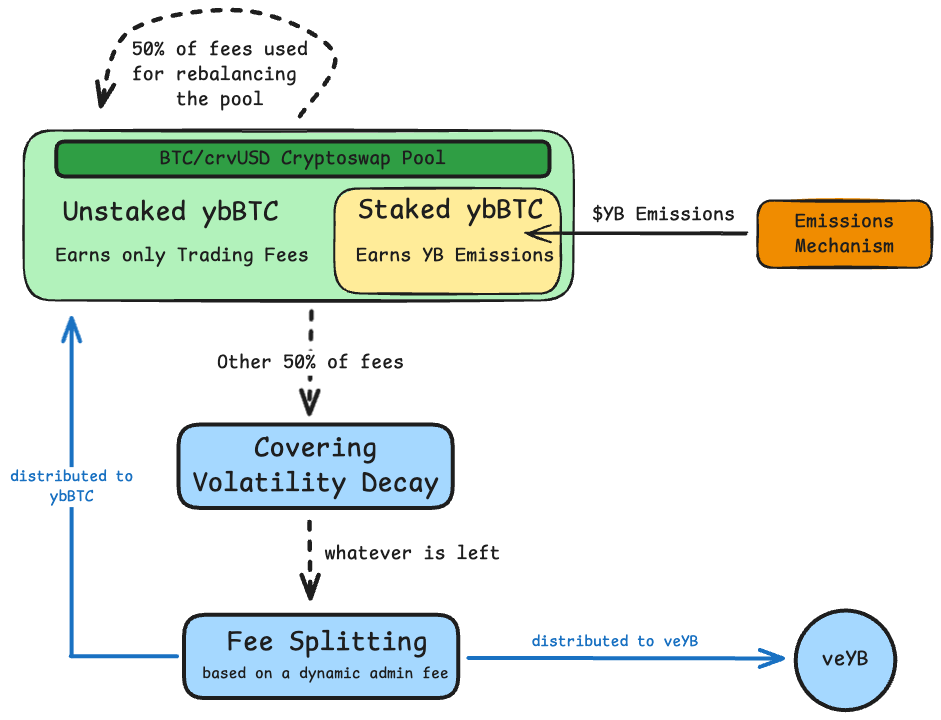

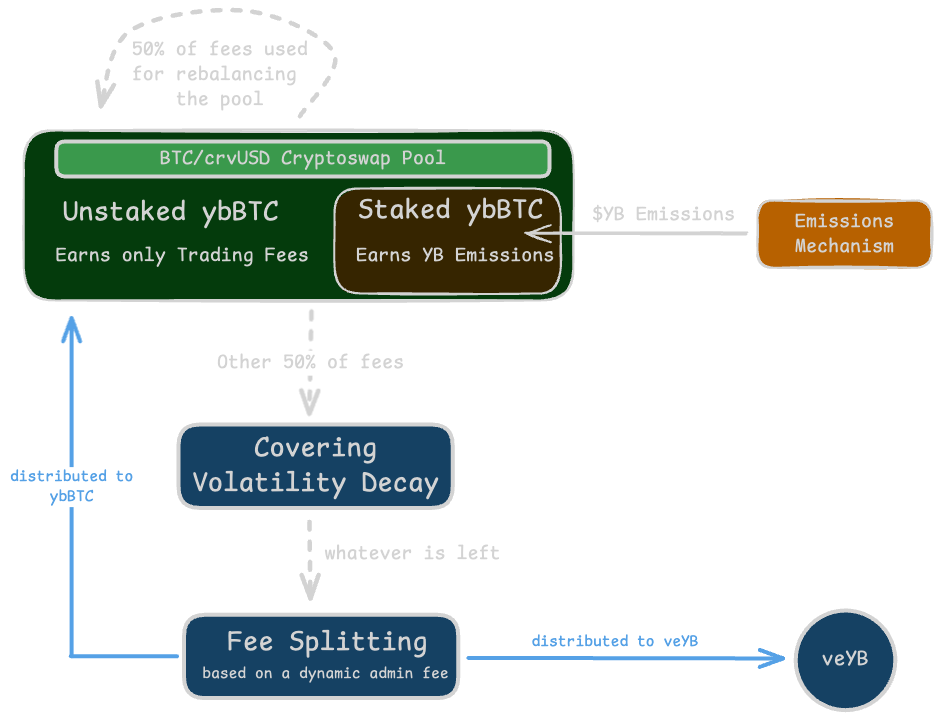

YieldBasis generates trading fees from the underlying BTC/crvUSD pools. These fees are distributed as followed:

- 50% → Pool Rebalancing: This portion funds the Curve pool's internal concentrated liquidity rebalancing mechanism.

- 50% → Available for Distribution: From this portion, volatility decay) costs (the expense of maintaining constant 2× leverage) are first subtracted.

- Net Distributable Amount: Whatever remains after covering volatility decay is split between unstaked ybBTC holders and veYB holders according to the dynamic admin fee.

Fee Distribution & Incentives

YieldBasis splits value based on participation types:

- Unstaked ybBTC — Earn real trading fees (minus a dynamic admin fee going to veYB). See ybBTC for details.

- Staked ybBTC — Forgo fees and receive YB token emissions instead (see Inflation & Emission).

- veYB holders — Receive the dynamic admin fee portion as protocol revenue (see veYB Token).

| Role | What is staked | What is earned | What is given up |

|---|---|---|---|

| Unstaked LP | nothing | BTC-denominated trading fees | YB emissions |

| Staked LP | ybBTC | YB token emissions | Direct trading fees |

| veYB (governance) | YB (locked) | Share of admin fees | Liquidity flexibility |

Dynamic admin fee: As more LPs stake, the protocol's admin fee (paid to veYB) increases. Fewer unstaked tokens share the remaining fee pie, so unstaked holders still capture meaningful yield. Moreover, since the number of tokens receiving yield scales linearly with , but the yield accorded to them scales only as a square root thereof, the relative yield increases sharply with an increase in , promoting unstaked ybBTC retention in such cases.

Full formula and examples are in Advanced Concepts & Economics.

Net APR Calculation

The net APR for YieldBasis is calculated using the following formula:

Where:

- : Fee APR earned by the underlying Curve pool (unlevered)

- : Borrow APR on the crvUSD CDP line

- : Effective APR cost of maintaining leverage (volatility decay)

Example:

If the Curve BTC/crvUSD pool earns 15% APR in trading fees (), the borrow rate is 10% (), and volatility decay is 5% (), then:

-

net APR

-

This 15% net value increase is then split between unstaked ybBTC and veYB based on staking ratio.

Math reference: The net APR expression and its assumptions are detailed in Math Primer §4 (Eq. 4.4).

The High Watermark (Recovery Mode)

YieldBasis protects LPs using a High Watermark mechanism. This ensures that the protocol never profits from fees while users are recovering from volatility costs (TRD).

What is the Watermark?

The High Watermark is the highest recorded performance level of the LP token (Price-Per-Share or 1:1 peg). It acts as the threshold for protocol profitability.

- Above Watermark (Healthy): When the share price is at a new all-time high, the system is "healthy." Trading fees are split normally between LPs and the Admin Fee.

- Below Watermark (Recovery): If volatility rebalancing costs cause the share price to dip below this level, the system is in Recovery.

- The Rule: While in Recovery, 100% of revenue is used to restore LP value. The protocol waives the Admin Fee entirely until the Watermark is reached again.

Note on "Missing" Fees: If you see high trading volume but zero Admin Fee accrual, the protocol is in Recovery Mode. This is a safety feature: the revenue is being actively used to refill the user's position value instead of paying the protocol.

Dynamic Admin Fee

The protocol uses a dynamic admin fee that adjusts based on staking participation to balance incentives between fee seekers (unstaked ybBTC) and governance token stakers (vote-locked YB).

How it works

- Minimum admin fee: When no one stakes, the admin fee is at its minimum (e.g., 10%)

- Dynamic adjustment: As more ybBTC gets staked, the admin fee increases non-linearly

- Maximum admin fee: When everyone stakes, the admin fee equals 100%

As more ybBTC gets staked, the dynamic admin fee increases, sending more fees to veYB holders (DAO). Here's the interesting part: unstaked holders actually earn MORE per token when others stake!

Why this happens:

- For example, when 50% of ybBTC is staked, unstaked tokens get 64% of all fees

- But only 50% of tokens are unstaked, so each unstaked token gets a bigger slice

- This means each unstaked token earns 28% more than if nobody staked at all

The math: Fewer unstaked tokens + proportionally more fees = higher yield per token

Staked holders receive YB token rewards instead of trading fees.

The effective admin fee formula reads:

Where:

- : Admin Fee

- : Stake Rate (s*/T where s* = staked supply of ybBTC, T = total supply)

- : Minimum Admin Fee (10%)

Fee Distribution based on Staking Percentage

How it works: As more ybBTC gets staked, the dynamic admin fee increases, diverting more fees to veYB holders (DAO). Unstaked holders see their fee share decrease, but with fewer unstaked tokens remaining, each still captures meaningful yield. Staked holders receive YB emissions instead of trading fees.

Economic incentives

When a small share of ybBTC supply is staked:

- Higher YB per ybBTC staked emissions rate (emissions concentrated among fewer staked tokens)

- Lower ybBTC yield per LP token (most fees go to unstaked holders)

When a large share of ybBTC supply is staked:

- Higher ybBTC fee yield per token (fewer unstaked tokens share the remaining fee pool)

- Lower YB emissions rate per staked ybBTC (emissions diluted among more staked tokens)

This creates a natural equilibrium where both strategies remain viable regardless of market conditions.

Fee Collection & Distribution

Trading fees are automatically harvested from the underlying Curve BTC/crvUSD pools and distributed according to the dynamic admin fee formula. See How YieldBasis Works for the technical mechanics.

Fee flow:

- Trading activity generates fees in the BTC/crvUSD pools

- YieldBasis harvests these fees from the leveraged LP position

- Dynamic admin fee determines the split between ybBTC and veYB. More about veYB rewards here.

- Distribution occurs based on current staking levels